Why EOFY is the Right Time for ABN Holders and Business Owners to Claim a Vehicle on Your Tax

For Australian business owners and sole traders, the End of the Financial Year (EOFY) is a prime opportunity to make strategic purchasing decisions that can help reduce your tax bill. This period is particularly advantageous for buying a vehicle for commercial use, as the EOFY sales offer significant discounts and incentives for ABN holders. Here’s why claiming a vehicle on your tax during EOFY is a smart move for Australians.

- Depreciation Deductions: Vehicles used for business purposes can be depreciated over time, meaning you can claim a portion of the vehicle’s value as a tax deduction each year. This spreads the tax benefits across multiple financial years, providing ongoing financial relief.

- GST Credits: ABN holders can claim GST credits on the purchase of a vehicle, further reducing the overall cost. This can be a substantial saving, especially on higher-value vehicles, effectively lowering the purchase price by 10%.

- Attractive Finance Offers: Many manufacturers offer special finance deals during EOFY sales like RAM listed below! These offers can improve your cash flow while still allowing you to take full advantage of tax benefits.

Current EOFY Offers for ABN Holders

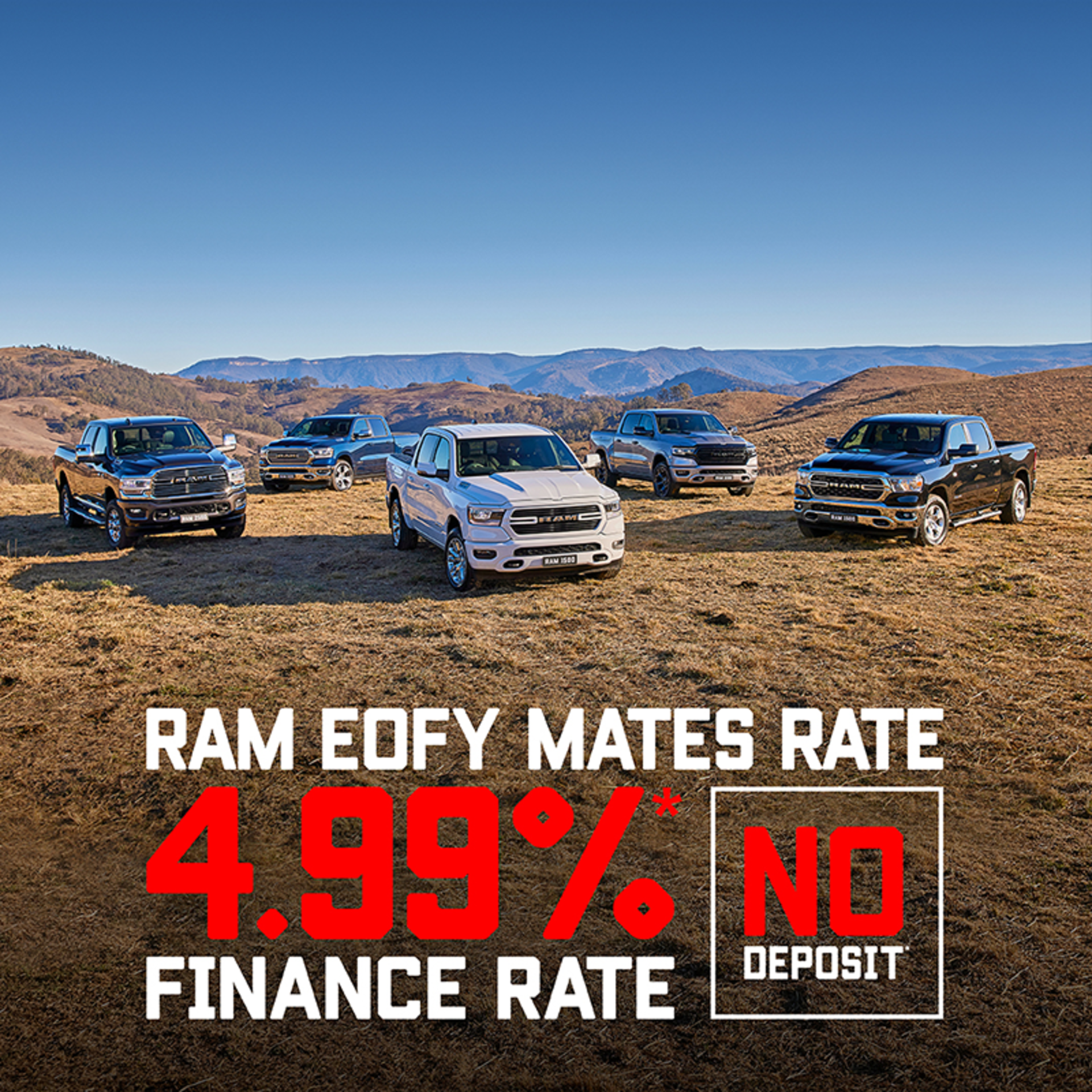

RAM

Ram Trucks Australia is offering a no-deposit Mates Rate 4.99% finance offer for new 1500, 2500, and 3500 utes sold between 17 May and 30 June 2024. This finance offer is valid for approved ABN registered buyers only. To view the full terms and conditions, click here.

Hyundai

For ABN holders looking for a van, Hyundai is currently offering a $1,000 ABN holder bonus on select STARIA Load models. With ample space for your business needs, the STARIA Load is available for immediate delivery starting from just $49,490 drive away*, learn more here.

LDV

At Tynan LDV in Kirrawee, Wollongong, and Albion Park, a limited number of MY23 plate clearance T60 Max stock is available from $35,990 Drive Away. These diesel dual cab vehicles feature an 8-speed ZF auto and a powerful Bi-Turbo Diesel Euro V Engine with 160kW of power and 500Nm of torque. They come with a 5-star ANCAP safety rating and a 7 Year/200,000km Warranty. Explore the available models here.

Jeep

Jeep's currently offering a 2.99% interest rate on Night Eagle and Rubicon MY22 & MY23 stock* for those wanting a versatile ute for both work and off-road adventures. This deal is available for ABN holders only, requiring a minimum 10% deposit and a 36-month term, ends June 30. Terms and conditions apply, view offer here.

Consult Your Accountant

While the benefits of purchasing a vehicle during EOFY are significant, it’s essential to consult with your accountant to understand how such a purchase will impact your specific tax situation. They can provide personalised advice based on your business’s financial status and ensure you maximize the available benefits.

Learn more about business claims on the ATO website here.

Visit Tynan Motors This EOFY

With multiple locations across the Sutherland Shire and Illawarra, including Miranda, Kirrawee, Sutherland, Wollongong, and Albion Park, Tynan Motors offers a wide selection of new, demonstrator, and used cars. Take advantage of the EOFY sales to find the perfect vehicle for your business needs and maximize your tax benefits. Visit us to see what deals we have for you this EOFY.

By making a strategic vehicle purchase now, you can enjoy the dual benefits of driving away in a new car and reducing your tax burden. Don’t miss out on these exceptional offers—head to Tynan Motors this EOFY and see how we can help you grow your business while saving money.